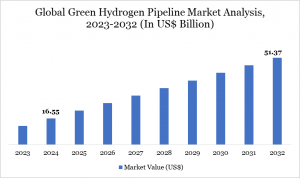

Green Hydrogen Pipeline Market is expected to reach US$ 51.37 billion by 2032 | DataM Intelligence

The Green Hydrogen Pipeline Market is expected to reach at a CAGR of 15.21% during the forecast period 2025-2032.

The Green Hydrogen Pipeline Market is emerging as a vital backbone for clean energy transport, enabling large-scale hydrogen distribution to support global decarbonization goals.”

AUSTIN, TX, UNITED STATES, January 14, 2026 /EINPresswire.com/ -- Market Overview:— DataM Intelligence

The Green Hydrogen Pipeline Market is emerging as a critical backbone of the global hydrogen economy, enabling large-scale transportation of renewable hydrogen from production hubs to industrial, commercial, and mobility end-users. As countries accelerate their decarbonization strategies, green hydrogen produced through electrolysis using renewable energy sources such as wind and solar is gaining prominence as a clean alternative to fossil fuels. However, without a robust and efficient pipeline network, the large-scale deployment of green hydrogen remains constrained. Pipelines offer the most cost-effective, safe, and continuous mode of hydrogen transport over long distances, supporting the development of hydrogen valleys, cross-border trade, and integrated energy systems.

To Download Sample Report Here: https://www.datamintelligence.com/download-sample/green-hydrogen-pipeline-market

According to DataM Intelligence, The Global Green Hydrogen Pipeline Market was valued at around USD 16.55 billion in 2024 and is projected to reach approximately USD 51.37 billion by 2032, growing at a CAGR of about 15.21% during the forecast period. This rapid expansion is driven by massive investments in hydrogen infrastructure, supportive government policies, and the growing need to decarbonize hard-to-abate sectors such as steel, chemicals, refining, and heavy transport. Europe currently leads the market due to its aggressive hydrogen strategy, cross-country pipeline projects, and strong regulatory support, while Asia-Pacific is expected to witness the fastest growth owing to large-scale renewable capacity additions and industrial hydrogen demand. Among segments, transmission pipelines dominate, as they form the core network connecting large green hydrogen production sites with industrial clusters and export terminals.

Key Highlights from the Report:

The Market is expected to grow at a CAGR exceeding 20% through 2032, supported by large-scale hydrogen infrastructure investments.

Transmission pipelines account for the largest share due to their role in long-distance hydrogen transport.

Europe dominates the market with extensive cross-border hydrogen corridor projects.

Asia-Pacific is projected to be the fastest-growing region driven by industrial decarbonization initiatives.

Steel and chemical industries represent the leading end-user segments for green hydrogen pipelines.

Government funding programs and hydrogen valley developments are accelerating pipeline deployment globally.

Market Segmentation:

The Green Hydrogen Pipeline Market can be segmented based on pipeline type, material, application, and end-user industries. By pipeline type, the market is broadly classified into transmission pipelines and distribution pipelines. Transmission pipelines form the main arterial network, transporting large volumes of hydrogen over long distances from centralized green hydrogen production plants to industrial hubs, storage facilities, and export terminals.

Distribution pipelines, on the other hand, are used for shorter-distance delivery to refueling stations, power plants, and local industrial consumers. The dominance of transmission pipelines reflects the current focus on building national and regional hydrogen backbone networks.

Based on material, the market includes steel pipelines, composite pipelines, and polymer-based pipelines. Steel pipelines currently hold the largest share due to their high pressure tolerance and established use in natural gas infrastructure, which can be repurposed or retrofitted for hydrogen transport. However, composite and polymer pipelines are gaining attention because of their resistance to hydrogen embrittlement, lower maintenance needs, and suitability for distribution networks.

In terms of application, the market serves power generation, transportation, industrial feedstock, and energy storage. Industrial feedstock remains the leading application segment, driven by the use of green hydrogen in ammonia production, refining, and direct reduced iron processes in the steel industry. From an end-user perspective, key segments include chemical manufacturers, oil and gas companies transitioning to low-carbon operations, utilities, mobility service providers, and hydrogen refueling infrastructure operators. The increasing integration of green hydrogen into these sectors is strengthening the demand for dedicated and repurposed pipeline networks.

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/green-hydrogen-pipeline-market

Regional Insights:

Europe currently represents the largest regional market for green hydrogen pipelines, supported by ambitious climate targets, strong policy frameworks, and extensive cross-border cooperation. The European Hydrogen Backbone initiative aims to develop tens of thousands of kilometers of hydrogen pipelines by 2030, connecting major production centers in the North Sea, Iberian Peninsula, and Eastern Europe with industrial demand hubs in Germany, France, and the Benelux region. The availability of existing natural gas infrastructure suitable for conversion further accelerates pipeline deployment across the continent.

Asia-Pacific is expected to witness the fastest growth over the forecast period. Countries such as China, Japan, South Korea, and Australia are heavily investing in green hydrogen production and export infrastructure. China’s large-scale renewable energy capacity and industrial hydrogen demand are driving the development of domestic pipeline networks, while Japan and South Korea are focusing on hydrogen import terminals and distribution pipelines to support fuel cell mobility and power generation. Australia is emerging as a key exporter, with pipeline projects connecting inland renewable-rich regions to coastal export hubs.

North America is also a significant market, led by the United States and Canada. The U.S. Department of Energy’s hydrogen hub program is fostering the development of regional hydrogen clusters, each requiring dedicated pipeline infrastructure. The repurposing of existing natural gas pipelines and the construction of new hydrogen-ready networks are key trends in the region. Meanwhile, the Middle East is positioning itself as a future green hydrogen export powerhouse, with large-scale pipeline projects planned to link solar-rich desert regions with ports and industrial zones.

Market Dynamics:

Market Drivers

The primary driver of the Green Hydrogen Pipeline Market is the global push toward decarbonization and net-zero emissions targets. Governments are increasingly recognizing green hydrogen as a vital solution for reducing carbon emissions in sectors where electrification is challenging. Large-scale renewable energy deployment, declining electrolyzer costs, and supportive policy frameworks are encouraging the establishment of hydrogen production facilities, which in turn require efficient pipeline networks. Additionally, the need for energy security and diversification away from fossil fuel imports is motivating countries to invest in domestic and cross-border hydrogen infrastructure.

Market Restraints

Despite strong growth prospects, the market faces several challenges. High capital costs associated with pipeline construction, material selection, and safety systems can limit project feasibility, especially in developing regions. Technical issues such as hydrogen embrittlement, leakage, and the need for specialized compressors and valves increase operational complexity. Regulatory uncertainties and the lack of standardized codes for hydrogen pipeline design and operation also pose hurdles to widespread deployment.

Market Opportunities

The market offers substantial opportunities through the repurposing of existing natural gas pipelines for hydrogen transport, which can significantly reduce infrastructure costs and deployment timelines. The development of international hydrogen trade routes and offshore pipeline networks linking renewable-rich regions with high-demand markets presents another major growth avenue. Furthermore, advancements in pipeline materials, monitoring technologies, and digital twin solutions are expected to enhance safety, efficiency, and lifecycle management, opening new revenue streams for technology providers and infrastructure developers.

Looking For Full Report? Get it Here: https://www.datamintelligence.com/buy-now-page?report=green-hydrogen-pipeline-market

Frequently Asked Questions (FAQs):

How big is the Green Hydrogen Pipeline Market today and how fast is it growing?

Who are the key players in the global Green Hydrogen Pipeline Market?

What is the projected growth rate of the Green Hydrogen Pipeline Market during the forecast period?

What is the market forecast for green hydrogen pipeline infrastructure by 2032?

Which region is estimated to dominate the Green Hydrogen Pipeline Market through the forecast period?

Market Companies:

ArcelorMittal

Cenergy Holdings

Fichtner GmbH & Co. KG

GF Piping Systems

Hexagon Purus

HyNet North West Hydrogen Pipeline

Pipelife International GmbH

Royal IHC

SoluForce

TÜV SÜD AG

Recent Developments:

United States:

December 2025: Energy firms advanced demonstration projects for hydrogen supply chains, emphasizing pipeline integration for liquefaction and transportation to bolster industrial decarbonization.

November 2025: Federal incentives under the Inflation Reduction Act spurred pipeline network expansions in regions like California and the Gulf Coast to support rising green hydrogen production.

October 2025: Infrastructure investments accelerated in hydrogen hubs, enhancing pipeline connectivity for zero-emission transport and power generation sectors.

Japan:

December 2025: An engineering conglomerate boosted investments in hydrogen infrastructure, focusing on pipeline networks within a broader supply chain push.

November 2025: A new 15-year contract-for-difference scheme launched to stabilize prices and accelerate low-carbon hydrogen pipeline deployment nationwide.

October 2025: Government strategies prioritized pipeline retrofitting alongside renewable integration to meet 20 million tons annual hydrogen supply goals by 2050.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Conclusion:

The Green Hydrogen Pipeline Market is set to play a pivotal role in shaping the future of the global clean energy landscape. As green hydrogen production scales up to meet decarbonization goals, the need for reliable, safe, and cost-effective transportation infrastructure becomes increasingly critical. Supported by strong policy backing, technological advancements, and growing industrial demand, the market is poised for robust growth over the coming decade. With Europe leading in infrastructure development and Asia-Pacific emerging as a high-growth region, green hydrogen pipelines will form the foundation of an integrated, low-carbon energy system, enabling the transition from pilot projects to a fully developed hydrogen economy.

Related Reports:

Small Hydropower Market

Wave Energy Market

Sai Kiran

DataM Intelligence 4Market Research

+1 877-441-4866

Sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.